关于超级应用的故事

Revolut Launches RevPoints to Reward Customers for Daily Spending

Editorial Team

•

Boxo

Top Super App Stories This Week:

Revolut Launches RevPoints to Reward Customers for Daily Spending

X Aims to Boost Bottom Line With Payments as Revenues Plunge

Superbank Launches Integrated Banking Services on Grab’s Indonesia App

Meet Weverse, a ‘Super App’ for Pop Stars to Sell Merch, Connect with Fans

Revolut Launches RevPoints to Reward Customers for Daily Spending

Revolut, with over 40 million customers globally, is transforming everyday spending into rewards through RevPoints. These points can be converted into airline miles, discounts on travel, accommodation, experiences, and more, without the need for credit card spending. Customers can transfer RevPoints to over 30 airline loyalty programs, including British Airways Executive Club and Flying Blue, making travel more accessible despite rising flight costs.

RevPoints can also be redeemed for significant discounts on premium holiday accommodations and experiences via the Revolut app's Lifestyle tab. Points can be used for discounts at top brands like French Connection and Dermalogica when shopping online with Revolut Pay. Users can earn points through various methods, including spending, rounding up spare change, and completing in-app challenges. New users can start with 3,000 points, equivalent to £60 in travel discounts, after 150 eligible transactions.

Revolut's Ultra plan offers substantial rewards, with customers earning up to 30,000 RevPoints annually for spending £2,500 a month, enough for a free round trip from London to New York or a £600 hotel discount. Since its trial launch in September 2023, over one billion RevPoints have been earned, with nearly 120 million points redeemed across seven European markets. Revolut continues to enhance its rewards program, expanding partner benefits now valued at over £4,255 GBP annually.

Source: The Fintech Times

X Aims to Boost Bottom Line With Payments as Revenues Plunge

Elon Musk's X is gearing up for a multiyear campaign to launch its payments business. According to documents obtained by Bloomberg, X plans to use payments to boost user participation and engagement on its platform. The strategy includes a digital dashboard for sending and receiving money, storing funds, and viewing transactions, with small fees for some services.

Despite plans to enhance user engagement through payments, X has faced significant challenges since Musk's acquisition in 2022. The company reported a 40% revenue decline in the first half of last year and a $456 million loss in early 2023. Regulatory pushback has also delayed international rollout plans for X Payments, which has licenses in 28 states.

Musk envisions X becoming a payments super app by the end of 2024, integrating various financial services. However, experts note that X faces stiff competition from established players like PayPal and the inherent challenge of convincing users to switch from their trusted financial institutions. The company must also secure business partnerships to attract a customer base, facing the classic "chicken and egg" dilemma in the payments industry.

Source: PYMNTS

Superbank Launches Integrated Banking Services on Grab’s Indonesia App

Grab users in Indonesia can now access banking services through Superbank directly on the Grab app. This integration allows users to open bank accounts, deposit funds, and make digital payments without needing a separate Superbank app. Superbank is also available as a payment method for all Grab services and offers quick loan services with flexible credit limits and terms.

Customers using Superbank on the Grab app can earn 6% annual interest on their savings, along with discounts and promotions. The digital bank has also introduced an auto-savings feature that provides a 10% interest rate per annum. This integration is part of Superbank's strategy to enhance its consumer offerings.

Superbank, formerly known as Bank Fama, was rebranded in early 2023 after Indonesian conglomerate Emtek Group acquired it in 2021. Grab and Singtel later bought minority shares in a $70 million deal. The bank has partnerships with Genesis and online lender Amartha to provide business financing for startups and women entrepreneurs.

Source: Tech in Asia

Meet Weverse, a ‘Super App’ for Pop Stars to Sell Merch, Connect with Fans

Weverse, a superfan platform owned by HYBE, is designed to enhance interactions between artists and fans. As a Super App, Weverse allows artists to post updates, livestream, and sell merchandise directly to their followers. It also offers machine translation in 15 languages, making it accessible to a global audience. Launched in 2019, the app had over 10 million monthly active users in the third quarter of 2023, with 90% of its user base being international.

The app supports deep fan engagement by providing a single platform for various activities. For example, BTS member Jin’s livestream after his military duty garnered over 2 million views in just 10 minutes, demonstrating the platform’s capacity for high interaction. Weverse consolidates fan activities like purchasing merchandise, watching videos, and communicating with artists, which were previously scattered across different platforms.

In exciting news, Ariana Grande is joining Weverse following a partnership with HYBE America. This move will include ongoing cooperation with her cosmetics brand, R.E.M Beauty. Grande's channel launch date is yet to be announced, but the partnership highlights Weverse's expanding influence in the global music and entertainment industry.

Source: Inside Retail

That's It For This Week!

Thank you for reading. We're excited to continue exploring this ever-evolving Super App landscape with you. Follow us on our social media channels for more updates:

Until the next Super App Stories, stay connected, stay super!

Turn your app into a Super App with Boxo

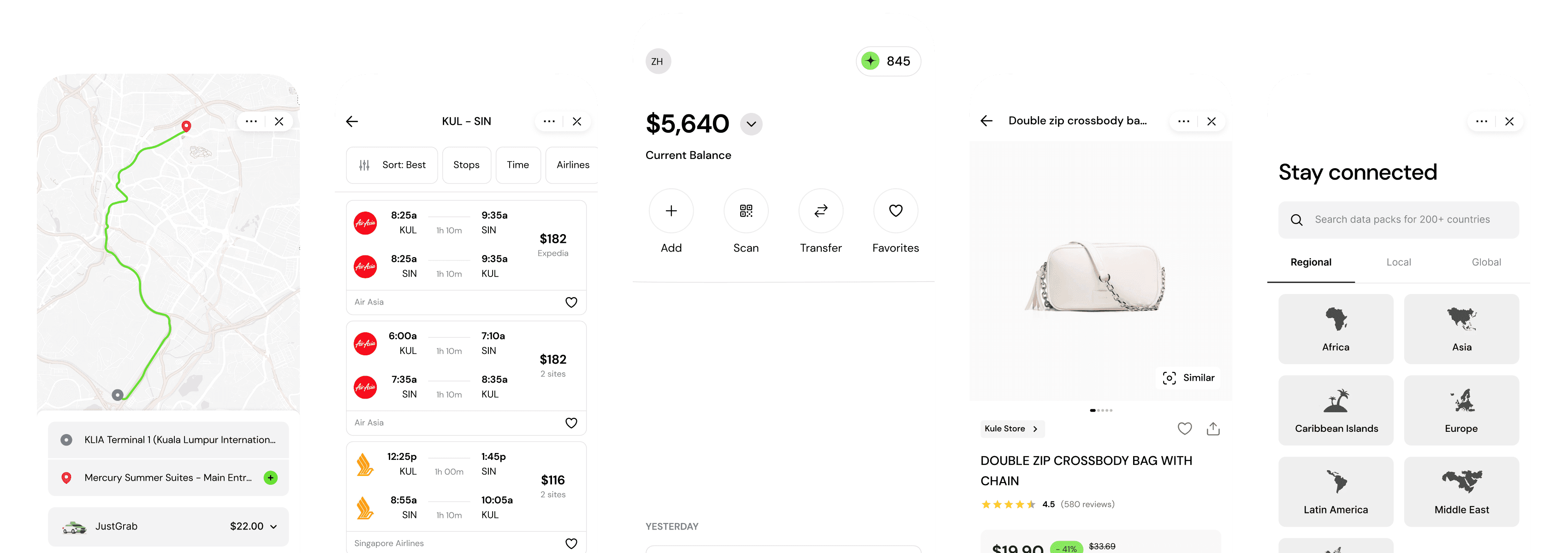

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

将您的业务领域拓展至新的高度,提升用户体验至全新水平。只需完成一次集成工作,您的用户即可享受到全天候、24/7的数字化服务。