关于超级应用的故事

CRED’s Super App Reveals its Revenue Stack

Editorial Team

•

Boxo

Top Super App Stories This Week:

CRED’s Super App Reveals its Revenue Stack

Super App Kaspi.kz Submits Interest for Humo Payments Privatisation in Uzbekistan

Flipkart super.money’s First Product Goes Live, Launches Co-Branded Credit Card

BNPL App Klarna Revenue Jumps 27% Amid IPO Preparations

PropTechBuzz Unveils Super App to Propel Global PropTech Industry

CRED Super App Reveals its Revenue Stack

CRED, the Bengaluru-based fintech giant, has been under scrutiny for its high valuation despite ongoing losses and a complex revenue model. However, in 2024, the company has begun to clarify its strategy by launching new products like CRED Money for personal finance management and acquiring Kuvera to expand into investment services.

CRED's FY23 revenue surged to INR 1,484 Cr (250% increase), while losses grew by 5% to INR 1,347 Cr. These moves are part of CRED’s broader strategy to boost revenue through its Super App approach, which now includes services ranging from UPI payments and credit card management to e-commerce, travel, and vehicle management.

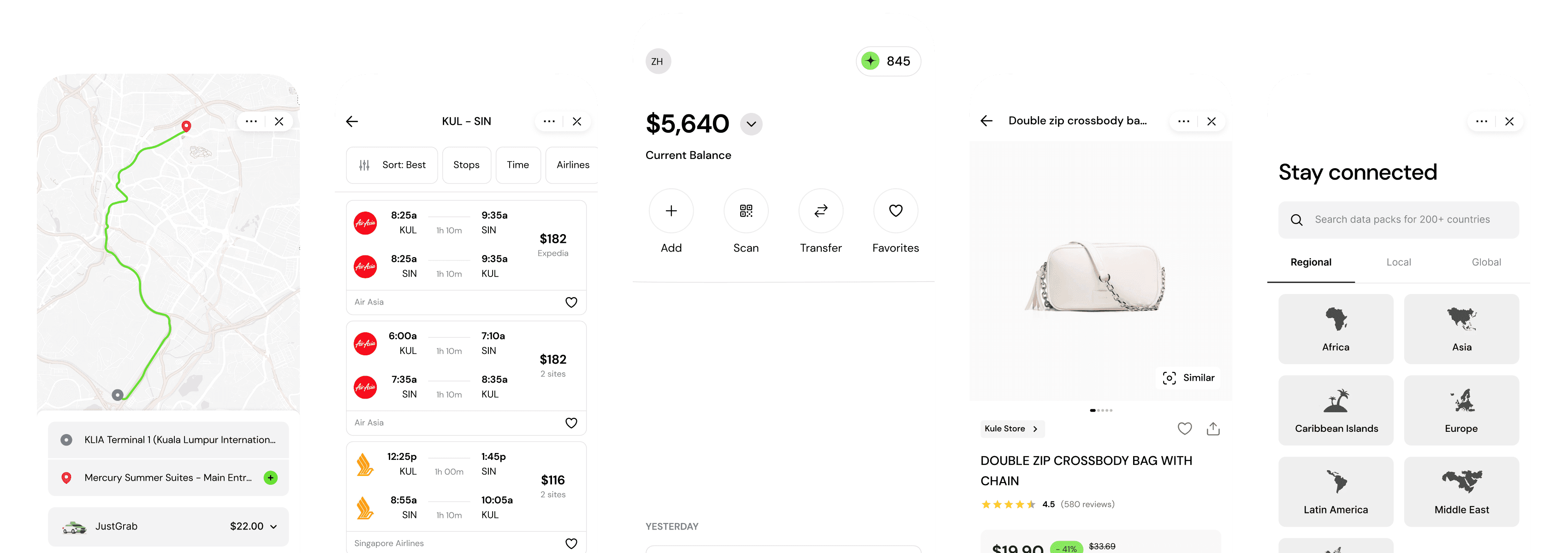

What's particularly interesting about CRED’s Super App strategy is its focus on high-frequency transactions and premium offerings. The company has secured a payment aggregator license, allowing it to process payments more efficiently and attract more merchants. Additionally, CRED has ventured into travel with CRED Travel and automotive services with CRED Garage, both of which target high-value users. The acquisition of Kuvera further positions CRED to compete with investment giants like Groww and Zerodha, aiming to create a comprehensive financial ecosystem under one platform.

Source: Inc42

Super App Kaspi.kz Submits Interest for Humo Payments Privatisation in Uzbekistan

Kaspi.kz, a leading Super App based in Kazakhstan, has officially expressed interest in participating in the upcoming privatisation of Uzbekistan's National Interbank Processing Center, known as "Humo." The State Assets Management Agency (SAMA) of Uzbekistan plans to privatise a 100% stake in Humo through a public negotiation process. Humo is a key player in Uzbekistan's payments infrastructure, having issued over 23 million cards, connected over 200,000 points of sale, and installed around 6,000 ATMs across the country.

The potential acquisition of Humo by Kaspi.kz is significant, as it aligns with the company's strategy to expand its digital payments ecosystem into new markets. Kaspi.kz, known for its innovative digital products, aims to leverage its 18 years of experience in the fintech sector to enhance Uzbekistan's digital payments landscape. The company's interest in Humo reflects its confidence in Uzbekistan's economic reforms and its commitment to contributing to the country's rapidly growing digital economy.

Kaspi.kz, backed by prominent investors like Fidelity, Blackrock, and Capital International, is a major player in the fintech industry, particularly in digital payments. Led by CEO Mikhail Lomtadze, the company has a strong focus on innovation and improving the everyday lives of consumers. The potential acquisition of Humo would allow Kaspi.kz to play a pivotal role in Uzbekistan's digital transformation, further solidifying its position as a leader in the fintech space.

Flipkart super.money’s First Product Goes Live, Launches Co-Branded Credit Card

Flipkart-backed fintech app super.money has launched its first product, a co-branded credit card called superCard, in partnership with Utkarsh Small Finance Bank. The card allows users to obtain credit limits as low as INR 90 by making deposits ranging from INR 100 to INR 10 Lakh. This new offering is part of super.money's effort to democratise access to credit in India, particularly through the ‘credit on UPI’ ecosystem, allowing customers across all segments to build their credit profiles while earning attractive interest on their deposits.

The superCard provides various benefits, including discounts on transactions made on Myntra, Cleartrip, and Flipkart, as well as supporting regular merchant payments and UPI transactions through the app's ‘Scan & Pay’ feature. Launched during the Global Fintech Festival, super.money’s founder and CEO, Prakash Sikaria, emphasised the card’s role in promoting financial inclusion by offering a path to formalised credit for millions of Indians who have been excluded from mainstream credit systems.

Super.money, which recently emerged from its beta testing phase, plans to expand its financial services ecosystem by introducing additional products like fixed deposits and instant pre-approved personal loans. This move comes as competition in India's digital lending space intensifies, particularly with the growing popularity of ‘credit on UPI’ offerings, a segment that has seen increased interest following the Reserve Bank of India's decision to include pre-approved credit lines on UPI.

Source: Inc42

BNPL App Klarna Revenue Jumps 27% Amid IPO Preparations

Klarna, the Swedish buy now, pay later (BNPL) app, reported a strong increase in revenues for the first half of 2024, growing by 27% compared to the same period last year. The company also posted an adjusted profit of $66 million, a significant turnaround from the $45 million adjusted loss in 2023. This growth comes as Klarna prepares to go public in 2025, with Goldman Sachs reportedly tapped to assist with its IPO.

Klarna's success is particularly notable in the U.S., where the company has marked its seventh consecutive profitable quarter. U.S. revenues grew by 38% year-over-year, with gross profits up 93% during the first half of the year. Klarna has become the partner of choice for 1 in 4 of the top 100 U.S. merchants, demonstrating the scalability and growing influence of its network in its largest market.

As Klarna expands its global footprint, the company is also positioning itself to capitalize on the super app trend. A PYMNTS Intelligence report highlighted that 41% of consumers would increase their banking activities if they had access to a Super App, a space where Klarna could potentially integrate its services. This aligns with Klarna's focus on building a next-generation commerce network that connects various financial services, making it a key player in the evolving fintech landscape.

PropTechBuzz Unveils Super App to Propel Global PropTech Industry

PropTechBuzz, a leading platform in the global proptech industry, has launched its much-anticipated Super App, marking a significant milestone in its mission to revolutionise the proptech sector. This new Super App aims to democratise access to proptech innovation, offering a comprehensive platform where users can discover, evaluate, and connect with proptech solutions from around the world.

The PropTechBuzz Super App is designed as a powerful, all-in-one tool that goes beyond just product discovery. It offers interactive product showcases, a global marketplace with business tools, real-time community engagement, and personalised content feeds. With features like live chats, forums, exclusive webinars, and tailored recommendations, the app facilitates seamless interaction among industry professionals, investors, and innovators, making it easier for users to navigate the rapidly evolving proptech landscape.

Founded by Ravi Kumar Sapata, PropTechBuzz has quickly become a cornerstone in the global proptech ecosystem since its website launch last year. The Super App is an extension of this success, offering a platform that not only connects users with the right proptech solutions but also fosters meaningful conversations and community engagement across geographies. Available on both App Store and Play Store, the app also supports products from related sectors like construction tech, urban tech, and retail tech, further expanding its impact on the industry.

Source: Open PR

That's It For This Week!

Thank you for reading. We're excited to continue exploring this ever-evolving Super App landscape with you. Follow us on our social media channels for more updates:

Until the next Super App Stories, stay connected, stay super!

Turn your app into a Super App with Boxo

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

将您的业务领域拓展至新的高度,提升用户体验至全新水平。只需完成一次集成工作,您的用户即可享受到全天候、24/7的数字化服务。