Case Study

Philippines' Telco to Fintech: How Globe Launched GCash Super App

Editorial Team

•

Boxo

The telecom industry in the Philippines has long been a cornerstone of communication and connectivity for millions of Filipinos. Dominated by a few key players, including Globe Telecom, the industry has continually evolved to meet the growing demands of its users. Globe Telecom, one of the leading telecommunications companies in the country, has not only provided essential communication services but has also ventured into strategic initiatives to enhance its service offerings. Among these ventures is GCash, a fintech wallet that has become a significant player in the digital financial ecosystem of the Philippines.

Some Back Story

In the early 2000s, the financial landscape of the Philippines was marked by limited access to formal banking services. A large portion of the population, especially those in rural areas, did not have bank accounts or access to traditional financial services. This lack of financial inclusion posed significant challenges, including difficulties in saving money, transferring funds, and making payments efficiently.

Recognizing these challenges, Globe Telecom envisioned a solution that would leverage its extensive telecommunications network to provide financial services to the unbanked and underbanked population. The goal was to create a platform that would bridge the gap between traditional banking and the everyday financial needs of Filipinos. This vision led to the birth of GCash, a mobile wallet designed to offer accessible and convenient financial services.

How Globe Launched GCash in Philippines

GCash was officially launched in October 2004 as an SMS-based money transfer service. This innovative solution allowed users to send and receive money using their mobile phones, a significant advancement in a time when access to banking services was limited. The introduction of GCash was Globe Telecom's response to Smart Communications' Smart Padala, which also aimed to provide financial services to the unbanked population.

The initial version of GCash enabled users to convert their physical cash into electronic money (e-money) through cash-in and cash-out outlets such as sari-sari stores, convenience stores, and pawnshops. These outlets charged a minimal transaction fee of ₱1.00, making the service affordable and accessible to a broad range of users. This network of outlets played a crucial role in the early adoption of GCash, as it allowed users to perform transactions without needing a bank account or internet access.

Transition to Digital: GCash Mobile Application Launch

In 2012, GCash took a significant step forward by launching its mobile application. This transition marked the shift from a predominantly physical outlet-based system to a digital, cashless ecosystem. The mobile app aimed to provide a more seamless and user-friendly experience, enabling users to perform a wide range of financial transactions directly from their smartphones.

The initial version of the GCash mobile app included features such as sending and receiving money, paying bills, and purchasing prepaid credits. This shift to a digital platform not only improved the convenience and accessibility of GCash services but also aligned with the growing trend of smartphone adoption and digitalisation in the Philippines. The user experience was designed to be intuitive, allowing even those with limited technological expertise to navigate the app with ease.

GCash's Journey to Become a Super App

The launch of the mobile app also paved the way for the introduction of new features and services. Over the years, GCash has continuously evolved, adding functionalities such as QR-based payments, online shopping, gaming credits, and interbank transfers through InstaPay. These enhancements have positioned GCash as a comprehensive fintech solution, catering to a wide range of financial needs.

For example, the partnership with CIMB Bank Philippines to launch GSave, a high-yield savings account, further exemplified GCash's commitment to financial inclusion and innovation. This collaboration allowed users to save money and earn interest directly through the GCash app, making banking services more accessible to a broader audience.

Here are the key features that make GCash a prominent Super App in the Philippines:

1. Money Transfers

Send Money: Users can send money to other GCash users instantly and securely.

Bank Transfer: The app supports interbank transfers via InstaPay, allowing users to send money to any bank account in the Philippines.

2. Payment Services

Bills Payment: Users can pay their utility bills, credit card bills, and more through the app.

QR Payments: GCash allows users to pay for purchases by scanning QR codes at partner merchants.

Online Shopping: The app can be used for online purchases at various e-commerce sites.

3. Digital Wallet Features

Cash-In and Cash-Out: Users can easily load their GCash wallet through partner outlets, bank transfers, or linked bank accounts. Cashing out can be done through partner outlets and ATMs.

GCash Card: A physical card linked to the GCash wallet, which can be used for in-store and online purchases, as well as ATM withdrawals.

4. Investment and Savings

GSave: A high-yield savings account in partnership with CIMB Bank, allowing users to save money and earn interest directly within the app.

GInvest: Users can invest in various investment products like mutual funds and bonds directly through the app.

5. Credit and Loans

GCredit: A revolving credit line that users can access to make purchases or pay bills even without a balance in their GCash wallet.

GGives: An installment payment feature that allows users to pay for big-ticket items in monthly installments.

6. Insurance

GInsure: Provides access to various insurance products, including health, life, and personal accident insurance, directly within the app.

7. Lifestyle and Rewards

GLife: A mini-app ecosystem within GCash offering services like food delivery, shopping, travel, and more.

GCash Forest: An environmental initiative where users earn green energy points for transactions, which can be used to plant trees in real life.

Rewards and Promos: Users can earn rewards points for transactions, which can be redeemed for discounts, freebies, and other promotions.

8. Remittances

GCash Padala: Allows users to send remittances to non-GCash users, who can then claim the money at partner outlets nationwide.

9. Mobile Services

Prepaid Top-Up: Users can top-up prepaid mobile credits for Globe and other telecom networks.

Buy Load: Purchase mobile load for any network in the Philippines directly through the app.

10. Government Services

Pay Government Fees: Users can pay for various government services such as taxes, SSS contributions, and more.

11. Marketplace

GCash Mall: An integrated marketplace where users can shop for various products and services directly within the app.

How Boxo Played a Role

In its drive to expand its ecosystem, GCash sought innovative solutions to create a seamless shopping experience for users and a smooth selling experience for merchants. By integrating advanced features and optimising user interfaces, GCash aimed to transform its platform into a one-stop-shop for all digital transactions, benefiting both consumers and sellers alike.

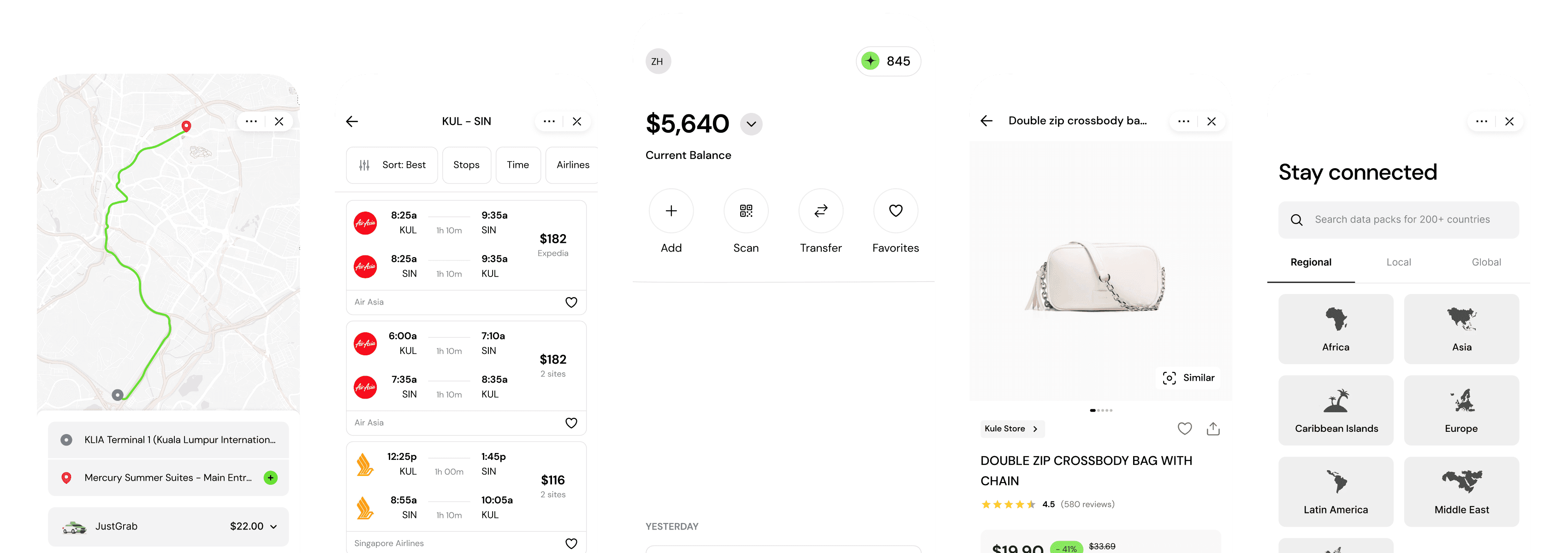

GCash has integrated the Boxo Marketplace Miniapp to transform its platform into a comprehensive e-commerce mall. This strategic move allows users to enjoy a seamless shopping experience directly within the GCash app, while enabling sellers to reach a broader audience with ease.

The collaboration marks a significant step in GCash's mission to expand its digital ecosystem and offer enhanced value to its users.

GCash Mini Program

The GCash Mini Program is a platform within the GCash app that allows third-party developers and businesses to create and integrate mini-apps or mini-programs. These miniapps offer additional functionalities and services, significantly enhancing the overall user experience. By enabling businesses to seamlessly integrate their services into GCash, users can access a broad spectrum of services, such as e-commerce, food delivery, ride-hailing, booking services, healthcare, education, and entertainment, without needing to download separate apps. This integration creates a seamless and convenient user experience, as users can perform various tasks within the GCash app itself.

The GCash Mini Program benefits the super app by increasing user engagement and retention. By offering a diverse range of services, users find more value and convenience in using GCash, leading to longer periods of app usage and higher user satisfaction. This platform also allows GCash to expand its service offerings without developing all the features in-house, attracting a broader user base with varied interests and needs. Additionally, the Mini Program platform encourages innovation from third-party developers, ensuring that GCash remains a dynamic and evolving platform. This strategic initiative reinforces GCash's position as a leading super app in the Philippines, providing a comprehensive, one-stop solution for multiple services and maintaining a competitive advantage in the fintech and super app market.

In Conclusion

GCash's journey from a simple SMS-based money transfer service to a comprehensive Finance Super App epitomises the transformative power of innovation in addressing financial inclusion challenges. By continuously evolving and expanding its services, GCash has significantly impacted the digital financial ecosystem in the Philippines, providing millions of Filipinos with convenient and accessible financial solutions. With strategic partnerships, the introduction of diverse features, and the integration of mini-programs, GCash has established itself as a leading super app. Its success not only highlights Globe Telecom's visionary approach but also sets a benchmark for other telecom companies looking to venture into fintech and digital services. As GCash continues to innovate and adapt to the needs of its users, it promises to remain at the forefront of the fintech revolution in the Philippines, fostering financial inclusion and enhancing the daily lives of its users.

Turn your app into a Super App

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

将您的业务领域拓展至新的高度,提升用户体验至全新水平。只需完成一次集成工作,您的用户即可享受到全天候、24/7的数字化服务。