South Africa's Telco to Fintech: How Vodacom Launched VodaPay Super App

Editorial Team

•

Boxo

The African digital penetration landscape is rapidly evolving, driven by significant advancements in mobile technology and a growing demand for online financial services. The latest edition of the African Digital Banking Transformation Report, released by African Banker in collaboration with Backbase, provides a comprehensive analysis of these developments. In the 30-page document report, it highlights the progress in digital banking, key focus areas for banks, and strategies to establish mobile app and internet banking functionalities.

Some Back Story

Banking access in Africa has seen notable improvement, with 48% of the population having access to banking services in 2022, up from 45% in 2017. This growth is largely fuelled by the popularity of mobile money and digital banking solutions. However, about half of the continent’s population remains unbanked, indicating substantial potential for growth. McKinsey forecasts a 10% annual growth rate in the African financial services market, projecting $230 billion in annual revenues by 2025.

Despite this progress, cash continues to dominate financial transactions in Africa, accounting for approximately 90%, while digital channels represent only 5% to 7%. In contrast, regions like Asia and Latin America boast higher digital banking adoption rates of around 50%. However, a new generation of urban, middle-class customers in Africa is emerging, preferring online transactions. Younger consumers are more inclined to adopt digital technology than their older counterparts, suggesting continued growth in digital banking services.

Mobile Dominance and Challenges

The accessibility of digital banking in Africa is heavily reliant on mobile phones, which account for about 75% of all online traffic. Therefore, banks are designing digital platforms primarily for mobile use, though ensuring seamless switching between devices is crucial.

However, the high cost of mobile handsets and data charges remains a significant barrier. In 2020, mobile internet costs in Africa accounted for 5.8% of the average income, making it the most expensive region for digital access globally. Despite this, the average cost of 1 GB of data and smartphones has decreased significantly between 2018 and 2021, pointing to a potential increase in the number of people able to access mobile banking services.

Given the increasing reliance on mobile technology and the need for affordable digital access, the entry of telcos into the fintech sector makes perfect sense in Africa. By leveraging their extensive mobile networks and customer base, telcos are well-positioned to offer tailored financial services that cater to a mobile-first consumer base, further accelerating financial inclusion and digital banking adoption across the continent.

How Vodacom Launched Vodapay in Africa

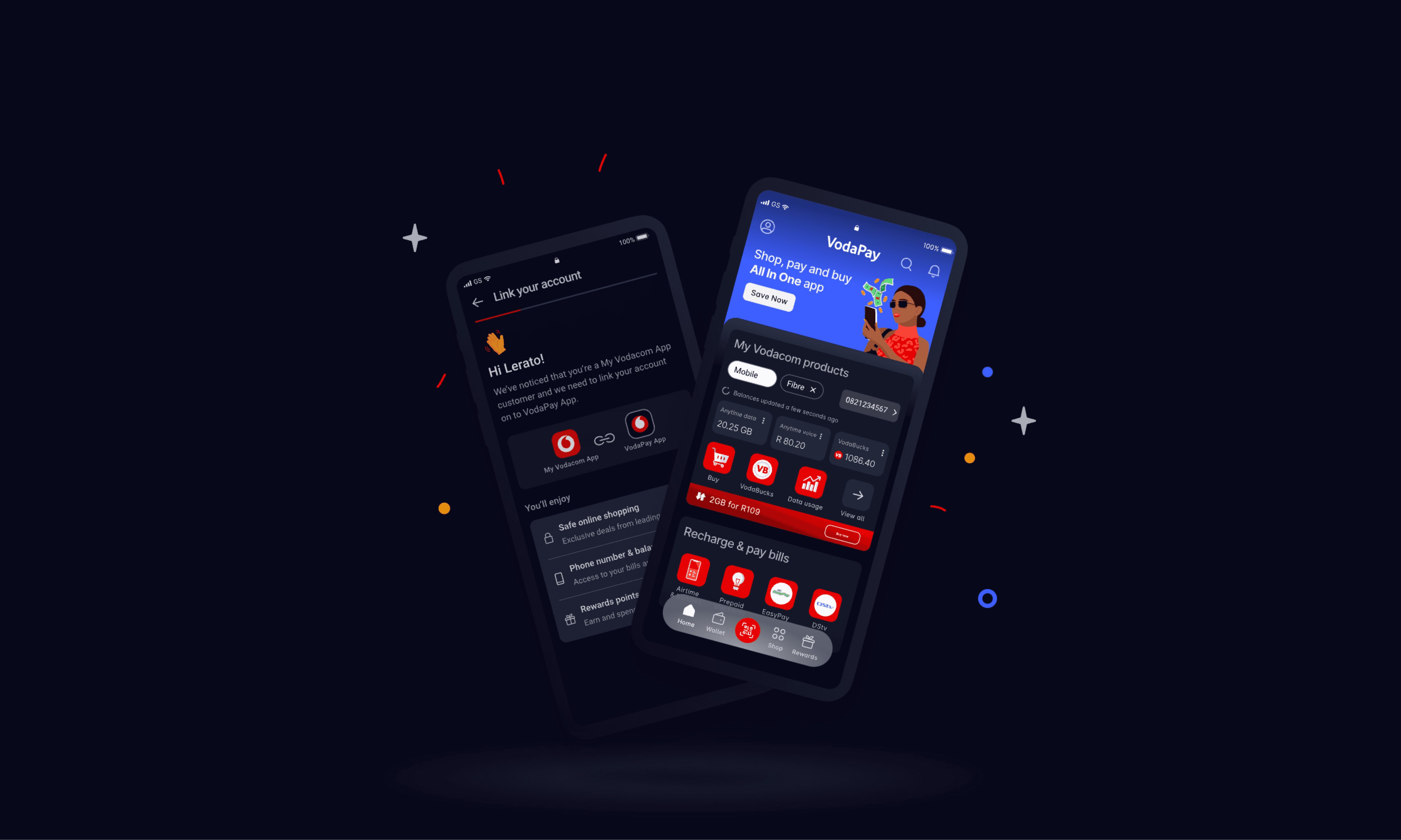

One of the most prominent examples of a telco successfully entering the fintech space is Vodacom with the launch of Vodapay. As Africa's digital economy grows, Vodacom identified the critical need for a comprehensive mobile payment platform that could serve the diverse financial needs of its users. Vodapay was developed to bridge the gap between traditional banking and the unbanked population, providing a wide array of financial services including money transfers, bill payments, and savings options, all accessible via mobile phones.

Vodapay's launch was a strategic move to capitalise on the high mobile penetration and the increasing demand for digital financial services in Africa. By offering a user-friendly and secure platform, Vodacom not only enhanced financial inclusion but also positioned itself as a leader in the continent's fintech revolution. The success of Vodapay exemplifies how telcos can leverage their existing infrastructure to offer innovative financial solutions, thereby transforming the financial landscape in Africa.

Vodapay's Journey to Become a Super App

Vodapay stands out as a comprehensive financial management tool, offering a wide range of features that cater to diverse user needs. From seamless money management and prepaid top-ups to rewarding interactions and comprehensive bill payments, Vodapay continues to innovate, ensuring users have a reliable and rewarding financial companion at their fingertips.

Seamless Money Management

Vodapay is initially built and designed to provide a simple, safe, and secure platform for managing your finances. The app allows users to send, receive, and manage money effortlessly. With the in-app wallet or registered cards, you can transfer funds to friends and family, make payments, and enjoy the convenience of scan-to-pay in stores. The app offers a comprehensive overview of your transaction history and statements, ensuring you always have control over your finances with just a tap.

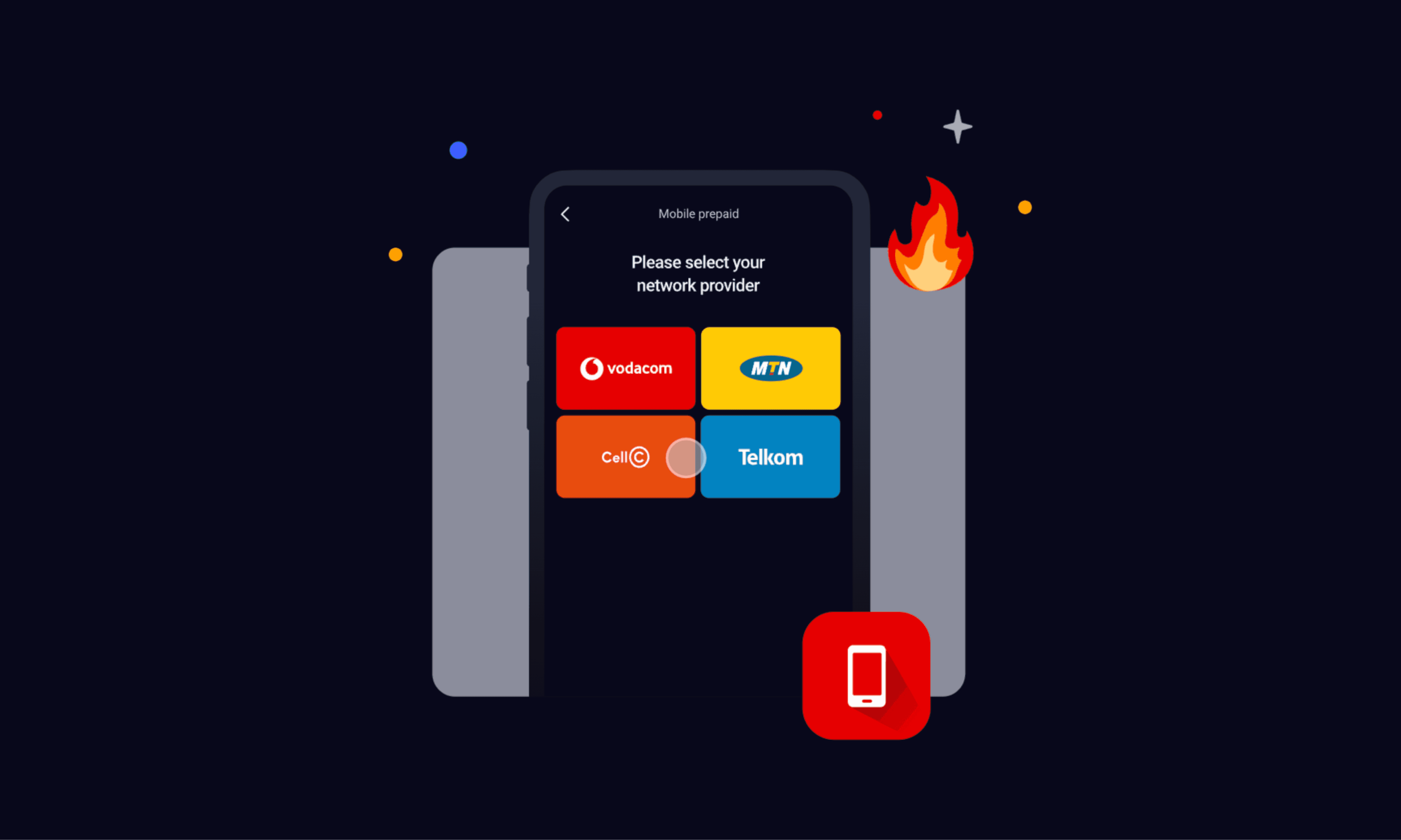

Convenient Prepaid Top-Ups

Vodapay extends its functionality beyond traditional financial services, offering a convenient solution for prepaid top-ups. Whether you need airtime, data, or SMS bundles, Vodapay has you covered, regardless of your network provider. Vodacom subscribers benefit even more, with exclusive coupons available when topping up through the app, adding extra value to their purchases.

Rewards for Every App Interaction

At Vodapay, user engagement is highly valued. The app offers tailor-made deals and a plethora of discounts, ensuring users are rewarded for their interactions. Every time you use Vodapay, you unlock rewards that enhance your overall experience, making financial management not only efficient but also rewarding.

Comprehensive Bill Payments

Vodapay simplifies bill payments and the purchase of prepaid utilities. Users can pay their bills and subscriptions directly through the app or buy prepaid water and electricity for themselves or others. This feature ensures that managing essential utilities is as easy as possible, providing flexibility and convenience at any time and from anywhere.

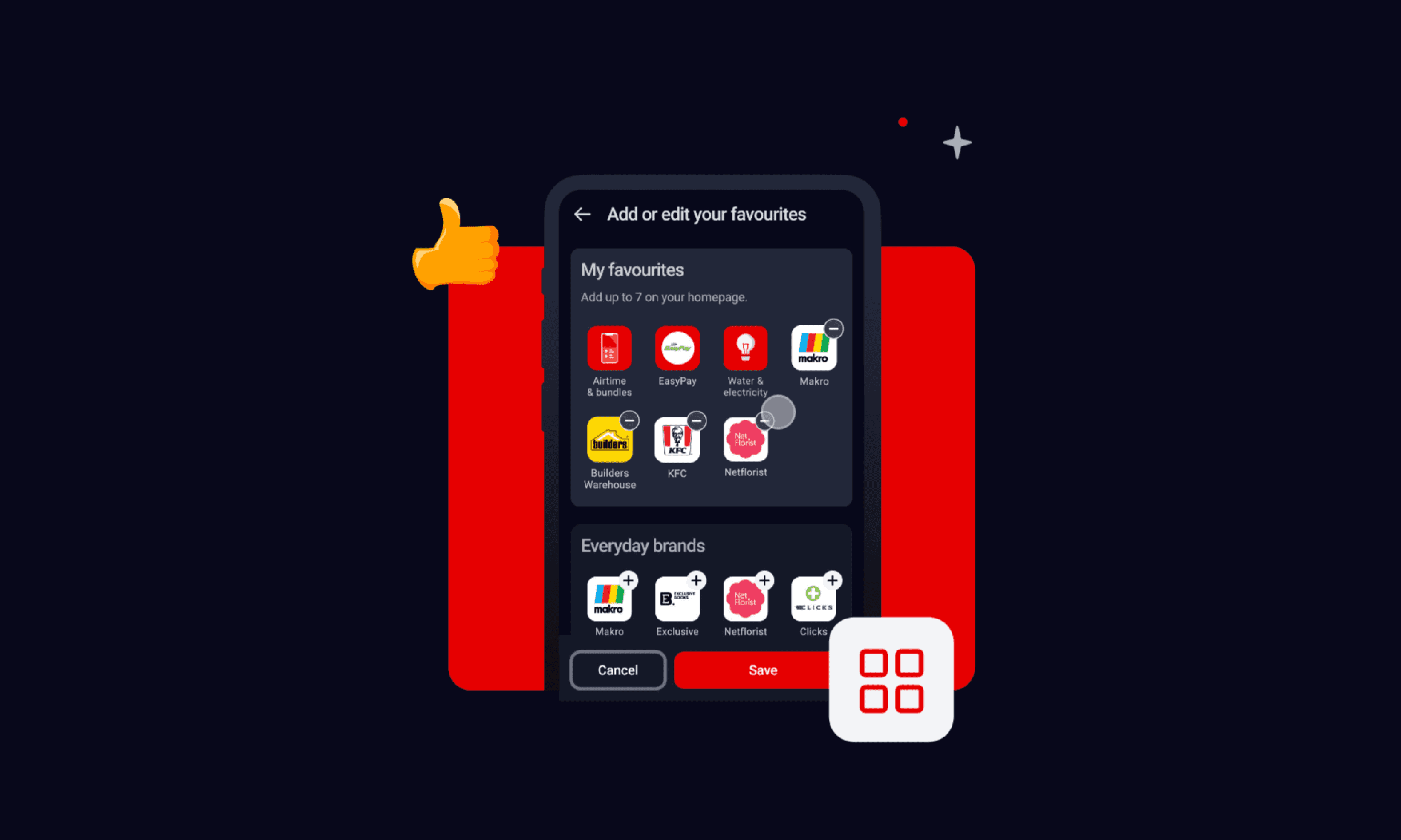

A Marketplace of Various Brands

One of Vodapay's standout features is its integrated marketplace, which hosts a variety of miniapps from different brands. This allows users to shop directly from a wide range of merchants without ever leaving the app. Whether you're looking for fashion, electronics, groceries, or other products, the marketplace provides a seamless shopping experience. Users can browse, select, and purchase items, all within the VodaPay app, making it a one-stop shop for all their needs.

How Boxo Played a Role

Vodapay is on a mission to enhance its service offerings and evolve into a full-fledged Super App. By exploring innovative solutions and integrating diverse functionalities, Vodapay aims to provide users with a seamless, all-in-one platform that caters to their financial, shopping, and lifestyle needs, setting a new standard for digital convenience in South Africa.

Vodapay utilised Boxo's Marketplace Solution to onboard more than 50 merchants and miniapps, creating a holistic shopping experience for users. The Boxo platform also provides a convenient solution for merchants to integrate seamlessly and effortlessly.

Vodapay Mini Program

In order to continuously and sustainably launch new services within the app, Vodapay launched its own Mini Program. The Mini Program technology is the answer to rapid mobile app development. Mini Programs are sub-applications that run inside the mobile app. You can access various services and features on Mini Programs without the need to install additional applications. Discover guides, tutorials and references to quickly get started.

With the Mini Program Development Platform, you can manage the whole lifecycle of mini programs. You can create a workspace and authorise developers to upload mini programs into the workspace with an approval process. You can also see the data with analytics and quality functionality to improve efficiency.

In Conclusion

The evolution of Africa's digital banking landscape is a testament to the continent's growing embrace of mobile technology and innovative financial solutions. The journey of Vodapay, from its inception to becoming a comprehensive Fintech Super App, underscores the transformative potential of leveraging existing mobile infrastructure to address diverse financial needs. By integrating a wide range of services, including seamless money management, prepaid top-ups, rewarding user interactions, comprehensive bill payments, and an integrated marketplace, Vodapay exemplifies how digital platforms can enhance financial inclusion and convenience. You too can take a step to become a Super App by partnering with Boxo to expand your service offerings and driving digital transformation for your users.

Turn your telco app into a Fintech Super App

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.