Nasdaq Expands Nubank Partnership to Drive FinTech Growth in LATAM

Editorial Team

•

Boxo

Top Super App Stories This Week:

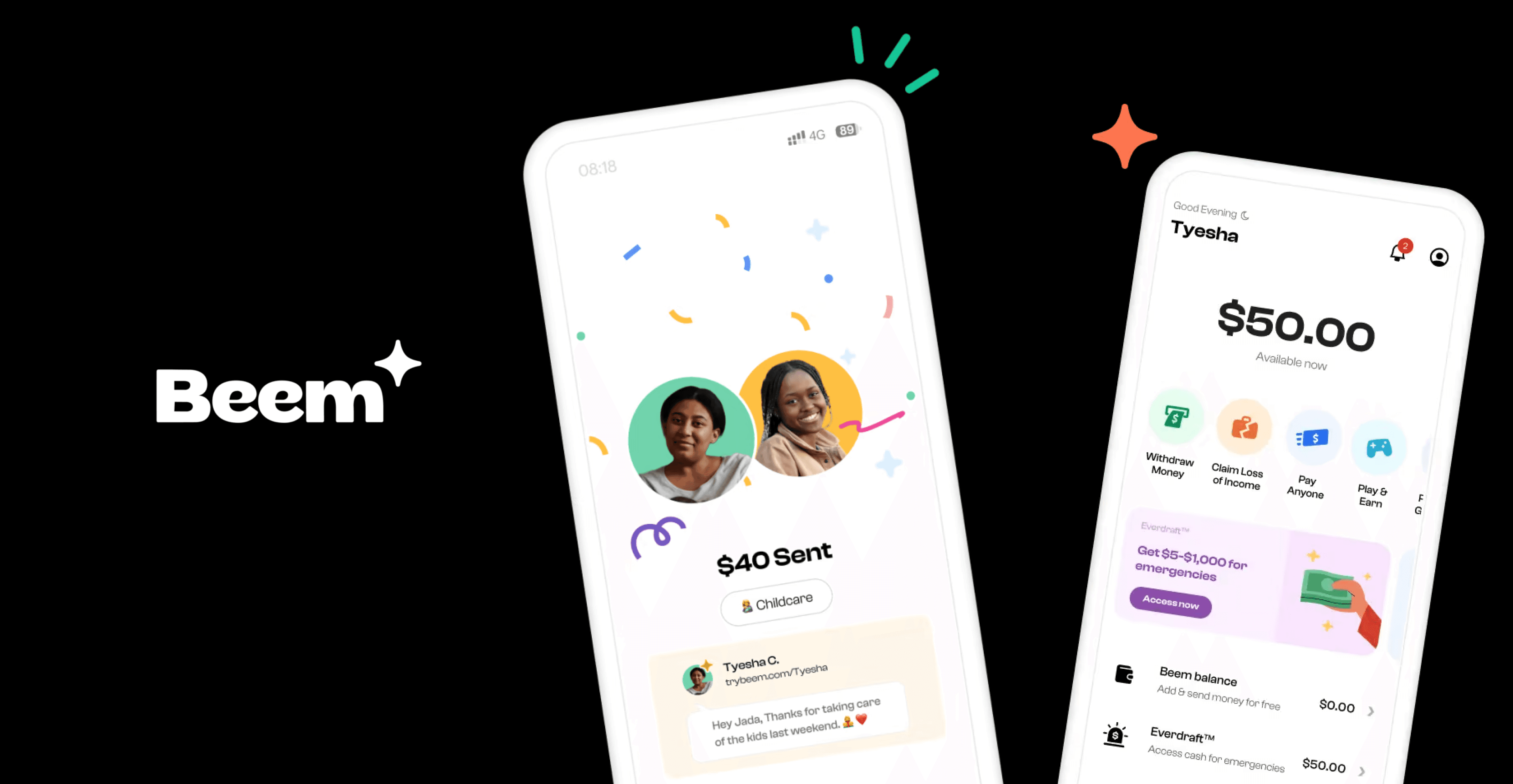

US AI Super App Beem Unveils In-App Arcade to Help Monetize Downtime

Nasdaq Expands Nubank Partnership to Drive FinTech Growth in LATAM

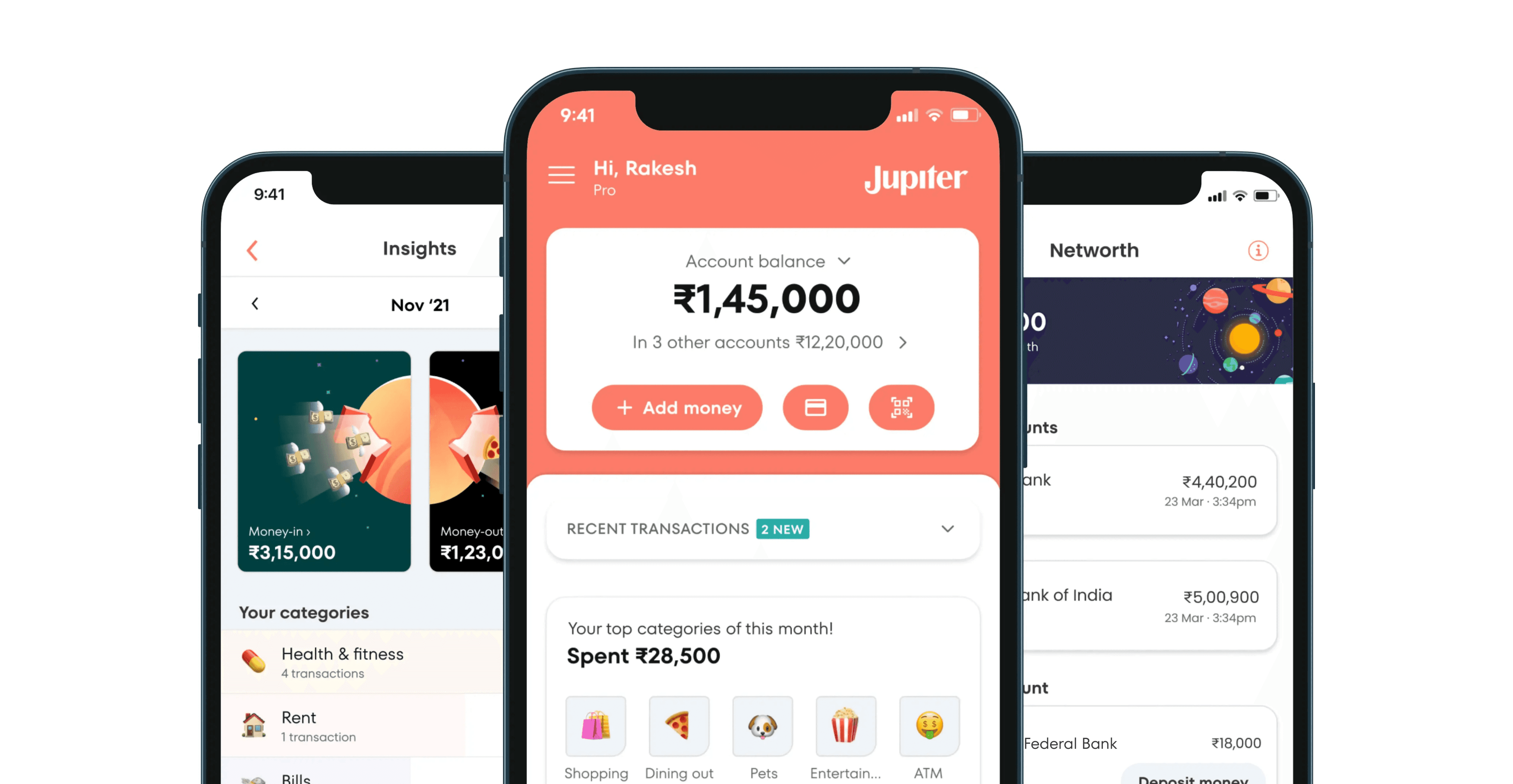

Fintech Jupiter in Talks to Buy a Stake in SBM Bank India

Former Revolut Product Lead Raised $30 million in Series B for SMBs Fintech Super App

US AI Super App Beem Unveils In-App Arcade to Help Monetize Downtime

Beem, a US-based AI-powered Super App, has launched Beem Arcade in partnership with adjoe, enabling users to earn money through casual mobile gaming. This feature leverages AI to monetize users' idle moments, transforming downtime into an income stream while enhancing customer engagement. By integrating AI deeply into its platform, Beem personalizes the gaming experience, tailoring game suggestions to individual preferences. This partnership not only boosts user retention and satisfaction but also aligns with Beem's mission of "Making Life Affordable for All" by providing tangible financial benefits through gaming.

Seamlessly integrated into the Beem Super App, Beem Arcade offers cash rewards for gaming milestones, which users can withdraw to their bank accounts. This innovative use of AI-driven gaming creates a new revenue stream for Beem while redefining what fintech apps can offer. Founder Akshay Krishnaiah emphasizes that Beem Arcade is just the beginning of their efforts to continuously innovate and leverage AI to enhance user experience and financial empowerment.

Beem is a San Francisco-based AI on the Application Layer fintech startup dedicated to making life affordable for all. Beem uses AI to help 100 of 128M households in the US reduce financial losses incurred due to personal and financial missteps by $2000 per year via subscription bundles offered on its mobile apps. Since its launch in Q4 2021, Beem has achieved remarkable growth, reaching 5 million downloads and 3 million customers. Beem's extensive partner network includes over 100 banks, fintechs, lenders, insurance providers, benefits managers, and credit unions. Beem has disbursed over $100 million to assist with emergencies and processed over $250 million in payments.

Source: The Globe and Mail

Nasdaq Expands Nubank Partnership to Drive FinTech Growth in LATAM

Nasdaq has expanded its digital banking technology presence in Latin America by providing its AxiomSL regulatory reporting solution to Nubank, a leading digital bank with over 105 million customers across Brazil, Mexico, and Colombia. This agreement extends Nasdaq's existing partnership with Nubank, which already includes support for its treasury functions, fixed income, and money market operations. The deal highlights the increasing demand for third-party financial technology solutions in Latin America, driven by the region's rapid digital banking growth and the need for advanced technology to bring new products and services to market quickly.

Nasdaq’s presence in Latin America extends to over 50 banking and payment services clients, including digital and traditional banks. By offering mission-critical technology and partnering with market infrastructure operators, Nasdaq helps these institutions navigate complex operational challenges. Ed Probst, Nasdaq’s Senior VP of Regulatory Technology, emphasized that digital banking in the region is evolving rapidly, with open banking and innovative tech empowering consumers. Nasdaq's technology supports this growth, providing clients like Nubank and others, such as Mercado Libre, C6 Bank, and Bankaool, with competitive advantages in a fast-paced industry.

Nu is the world’s largest digital banking platform outside of Asia, serving over 105 million customers in Brazil, Mexico and Colombia. In 2018, Nubank achieved unicorn status with a valuation of $1 billion, and in 2021, it went public with an IPO valuation of $45 billion. As of 26 Feb 2024, its market valuation stands at $50.8B. The company is built on an efficient and scalable business model that combines low cost to serve with increasing returns. Nu’s impact has been recognized by numerous awards, including Time’s 100 Most Influential Companies, Fast Company’s Most Innovative Companies and Forbes’ World’s Best Banks.

Source: The Paypers

Fintech Jupiter in Talks to Buy a Stake in SBM Bank India

Indian Neobank Super App Jupiter is in discussions to acquire a 5% to 9.9% stake in SBM Bank India, according to sources familiar with the matter. Backed by Tiger Global and Nubank, Jupiter is pursuing this acquisition as part of a broader trend where Indian fintech startups are seeking partnerships with traditional banks to expand their market reach. The deal is yet to be finalized and would require approval from the Reserve Bank of India (RBI).

This move aligns with the growing interest from fintech companies and venture capital firms in forging ties with lenders in India. For instance, fintech Slice recently merged with North East Small Finance Bank after receiving RBI approval, and VC firms like Lightspeed and Sorin have invested in Shivalik Small Finance Bank. Despite partnerships with banks like Federal Bank, neobanks in India, including Jupiter, have experienced slower adoption compared to markets like Brazil, where they’ve gained more traction.

Source: TechCrunch

Former Revolut Product Lead Raised $30 million in Series B for SMBs Fintech Super App

Former Revolut product lead Bogdan Uzbekov has raised $30 million in Series B funding for his fintech company, Apron, which aims to become the Financial Super App for small and medium businesses (SMBs). The round was led by existing investor Zinal Growth, founded by Guillaume Pousaz of Checkout.com, with participation from Index, Bessemer, and Build Collective, Tony Fadell’s investment firm. Apron, founded in 2021, had previously raised $20.5 million in funding and plans to use the new capital for growth and product development.

Apron seeks to streamline SMB payments by offering an all-in-one platform for businesses to handle payments, invoicing, and payroll. Uzbekov’s experience at CashApp highlighted the gap between consumer and business payment systems, with business payments lagging behind in user experience. Apron addresses this by offering features like paying suppliers and employees, sending invoices, and allowing credit card payments to non-accepting vendors. The company operates on a subscription model and plans to introduce new products, including a business expenses card and improved invoicing tools.

Uzbekov credits his time at Revolut for shaping his approach to building Apron, blending Revolut’s fast execution with Square’s product depth. Revolut has become a "founder factory," with at least 15 businesses launched by its former employees in the last year alone. As Apron continues to focus on growth and product expansion, it is currently gross-profit positive but not yet aiming for profitability, despite recording a loss of £3.9 million in 2023.

Source: Sifted

That's It For This Week!

Thank you for reading. We're excited to continue exploring this ever-evolving Super App landscape with you. Follow us on our social media channels for more updates:

Until the next Super App Stories, stay connected, stay super!

Turn your app into a Super App with Boxo

Boxo is on a mission to accelerate the adoption of Super Apps globally. We enable the seamless integration of a range of value-added services, such as marketplaces, flight booking, and insurance, into any app. We deliver these services through pre-built, white-label miniapps across various sectors, such as E-commerce, Travel, Financial, and Lifestyle. Boxo currently works with 10 Super Apps worldwide, including GCash, Binance, Touch’N’Go, and VodaPay, and empowers more than 600 miniapp integrations, reaching a combined user base of over 500 million.

Share this Article

Super App Stories is a once-a-week newsletter offering in-depth analysis on trends and stories about Super Apps all around the world.